New Technologies Make Banking Easier

Advances in technology driven by World War II made a lasting impact on life after the war. People quickly found new ways to put them to use, and suddenly tasks that used to take manual effort became automated.

Advances in technology driven by World War II made a lasting impact on life after the war. People quickly found new ways to put them to use, and suddenly tasks that used to take manual effort became automated.

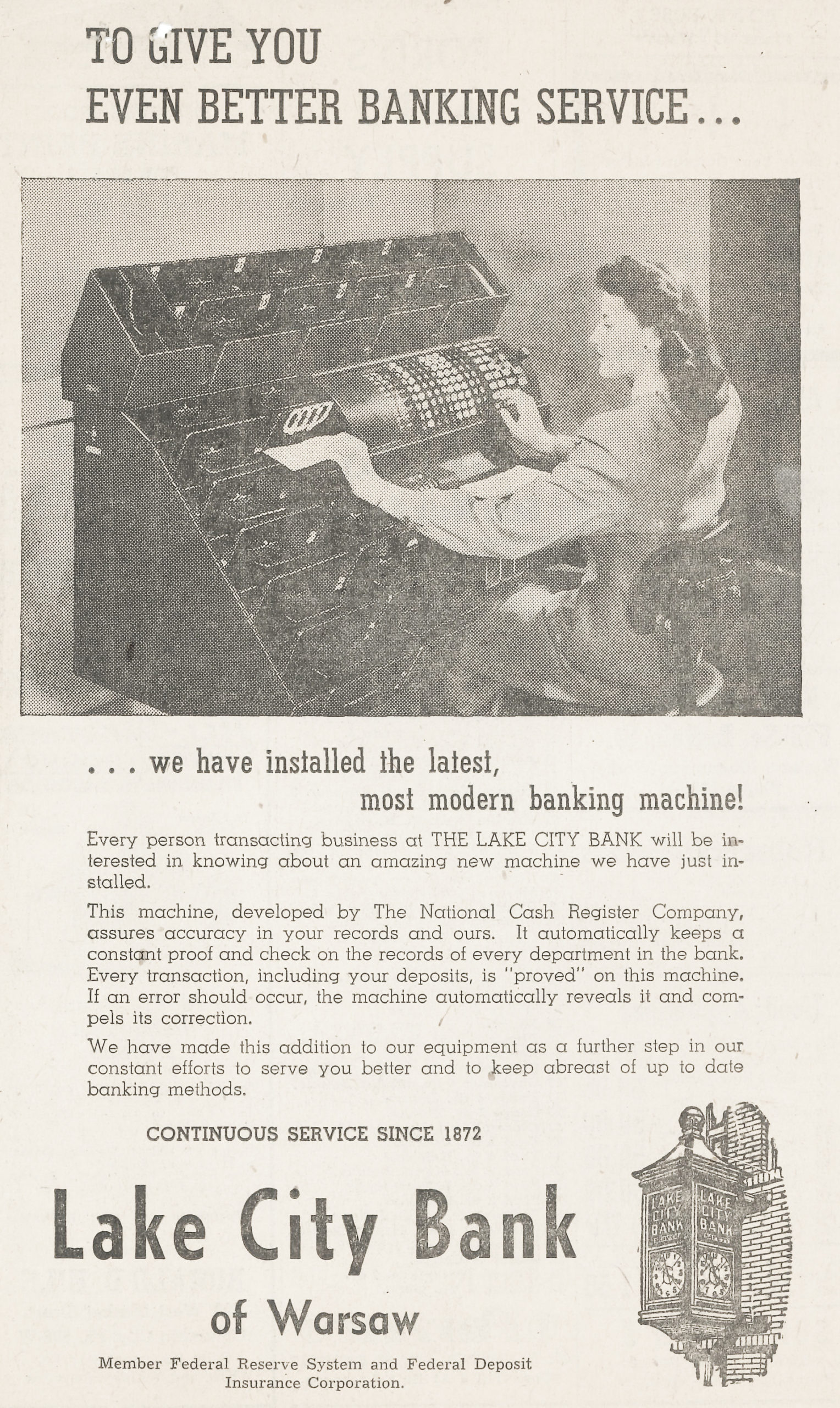

The effects of automation made a big impact in banking. Locally, Lake City Bank led the way. In 1950, the bank installed its first automatic proof machine. Its introduction was such a big deal that the Warsaw Times-Union promoted it in an article. It read, in part:

Patrons of the bank may have been wondering in recent weeks why tellers at the Lake City Bank never add up the items on the deposit slips to confirm the figures. The proof machine is the answer. Every deposit is “proved” by the machine after the customer leaves—making mistakes impossible and saving valuable time for the customer at the window.

In the years that followed, banking processes changed at an unprecedented rate. Computers made their way into the industry by the 1960s, and in 1964, Lake City Bank computerized its demand deposit accounting. This drastically improved the bank’s operations by reducing errors, speeding up accounting processes, and enhancing reporting. Daily accounting that once could take days to complete now was wrapped up by 8 am the next business day.